EU VAT One Stop Shop

EU VAT One Stop Shop

Just recently, on 1 July 2021, new VAT rules for ecommerce companies were introduced in the European Union to “offer businesses a simple and uniform system to declare and pay their VAT in the EU via VAT One Stop Shop/Import One Stop Shop”, resulting in a fair competition. Growww Digital invited an expert for a webinar to discuss this topic more in detail. Lilla Németh, director of tax services at RSM (a leading accounting and tax consulting firm in Hungary), summarised the most important aspects of these regulations in her presentation covering the following points:

- The scope of the new EU legislation

- Obligation for VAT registration

- The new EU schemes: non-Union, OSS, IOSS

- Sales platforms and interfaces

The scope of the new EU legislation

Lilla Németh talked about the most important aspects and changes in the EU VAT legislation regarding the ecommerce sector. Ecommerce businesses should be aware of these changes and act accordingly. It’s worth having a look at the new pieces of information, but since it’s a rather complex field, asking for advice from an expert may be necessary.

Now let’s see the main points of the new regulations.

Which scope do you need to consider as an ecommerce company?

- The transactions need to be cross-border transactions, e.g. from one EU country to another EU country or from a non-EU country to an EU country

- Mainly the B2C market is involved: buyers are either private individuals or companies that do not have the right for the VAT deduction

- Only for ecommerce activities

Which elements are out of scope?

- Products shipped to 3rd (non-EU) countries or within an EU member state (e.g. from Hungary to Hungary)

- B2B transactions, comprising buyers that are taxable entities

- Selling from an inventory stored in a warehouse within the EU

Useful questions that help you to decide if the new legislation (OSS/IOSS) is applicable or not for your activity:

- Where is the seller seated (EU / non-EU)?

- From where is the consignment departing, service provided (EU / non-EU)?

- Where does the consignment arrive at or where is the consumer of the service located (EU / non-EU)?

- Is the customer a taxable business or not (B2B or B2C)?

- What is the volume of the sales (under/over EUR150)?

- What other transactions does the seller have?

- Is it product sales or service sales?

- Is there a platform involved?

Obligation for VAT registration in the country of consumption

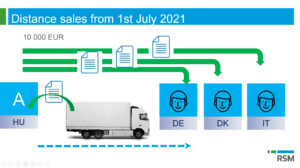

According to the new EU law, you, as an ecommerce company, are obliged to VAT register in the EU country of consumption if you surpass the EUR10,000 threshold of the value of products and services sold (via distance sales, excluding your own country) in all EU countries (not by country). E.g. If you are an ecommerce store, seated in Hungary, which sells to German, Danish and Italian customers, you need to add up all these EU sales and if that surpasses EUR10,000, you have to apply the different country-specific VAT rates.

You can avoid separate country VAT registrations by registering for the OSS/IOSS/non-Union scheme in only one EU country (including your own country if it is a member state of the EU) from where you can manage the separate VAT rates for the other EU countries.

The EUR10,000 threshold is calculated annually, it is cumulative, it is based on the net figures and includes both products and services sales.

The new schemes effective from 1 July 2021

The three new schemes are the following:

- Non-Union Scheme – only for services, only B2C, only for non-EU companies

- OSS Union Scheme – B2C distance sales for products and services, for both EU and non-EU companies

- IOSS Scheme – only for products, for both EU and non-EU companies, only for consignments of low value (below EUR150)

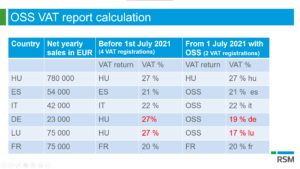

Let’s see an example for the OSS Scheme:

A Hungarian company sells products to private customers living in several EU countries. Most (but not all) of the inventory is located in Hungary. For the French buyers a separate inventory is kept in France for fulfilling fast delivery in France.

The report calculation will look like this (before/after 1 July 2021):

For a full explanation, please watch the video (36:50-41:40)

The IOSS Scheme

For the consignments valued below EUR150, the IOSS Scheme can be applied, but, similarly to the OSS Scheme, it is a possibility and not an obligation. It’s important to know that if a non-EU company wants to apply the IOSS Scheme, it needs to appoint an approved EU-seated intermediary that can register the non-EU company for the IOSS Scheme.

If you, as an EU ecommerce store, import consignments valued under EUR150 from a non-EU country (e.g. China) and sell these within your own country, you don’t have to pay import VAT, but if you sell to another EU country, import VAT is payable in your country.

Additionally, you can still follow the “normal” import process without using the IOSS Scheme or if you sell products over the value of EUR150. You can also trade via special arrangements, e.g. using postal operators, express carriers, customs agents, etc. being responsible for customs clearance and IOSS declarations—in this case, however, the customer will have to pay for the import VAT and customs.

OSS vs. invoicing

Regarding the invoicing requirements, a simplified process has taken effect.

If the ecommerce business is registered for either the OSS or the IOSS Scheme, a receipt is enough to be issued, however, if the customer requests an invoice, the company is obliged to issue one according to the rules of the country that granted the OSS or IOSS number and the VAT of the destination country is to be applied.

If the company has no registration for the OSS or IOSS, it has to issue invoices for the EU distance sales either based on the rules of the destination country (if the EUR10,000 threshold is met or under voluntary registration) or the country of departure (if the threshold is not reached).

Platforms (online electronic interfaces)

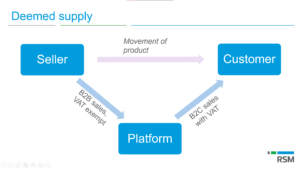

All interfaces facilitating the sales process between the seller and the buyer can fall in this category, e.g. marketplaces, websites, portals, gateways. If sales go through platforms of the kind, they are obliged to collect, report and pay the VAT under the following circumstances:

- distance sales of goods imported to the EU with a value not exceeding EUR150

- and/or supplies of goods to customers in the EU, irrespective of their value, when the underlying seller is not established in the EU.

Here it is considered as “deemed supply” by which we mean that although the product is transported directly to the customer, from a VAT perspective the seller is selling to the platform (VAT exempt B2B sale) and then the platform is selling to the customer (B2C sale including VAT).

For more detailed explanations, please watch the whole recording of the webinar here: